Project

“It was amazing, easiest taxes I've ever prepared! Really impressed that this was put together by the IRS.”

—Response from taxpayer post-submission survey

Direct File is a groundbreaking new tool that allows eligible taxpayers to file their taxes online, for free, directly with the IRS. It launched as a pilot for filing season 2024 as part of a year-long effort to test the interest in and feasibility of this new filing option. It supported a limited set of tax situations and was rolled out in a phased approach—to test the new system and learn from taxpayers. The pilot performed well and received rave reviews from taxpayers, leading the IRS to make the tool a permanent option for the 2025 filing season.

The pilot year was all about building a thoughtful foundation that we could learn from, and that could potentially grow over time. I’d like to share some of the early work that led to the pilot’s success. And then dive into my specific role. (You can also read my write-up on expanding scope and functionality in year 2.)

I was a design lead across multiple workstreams for the Direct File pilot. I wore many hats, including designing the Income section, leading the design of new patterns, supporting user research, and helping build a culture of collaboration. I served as a contractor in the pilot, and then joined the new in-house team at the IRS in year 2.

We had an amazing core team of 75 people from the IRS, the U.S. Digital Service (USDS), 18F, and 2 contracting agencies—Coforma and Truss. This team was comprised of researchers, designers, content strategists, product managers, data scientists, engineers, and tax experts, all working together to improve the tax filing experience. (We also benefitted tremendously from partnerships with states, community organizations, tax-advocacy groups, and supporters throughout government.)

Discovery

Filing taxes in the U.S. is really hard. 2 key challenges the team wanted to address:

Discovery

“At the end of the day, I am a big believer in paying taxes but the enormous stress I’m incurring with my family, it’s not worth it, right? I really wish things were much simpler.”

—From a taxpayer user interview

Early research on interest and feasibility was conducted at the beginning of 2023 (before I joined the team). This included user research, usability testing on a tightly scoped prototype, and multiple surveys. The majority of taxpayers expressed interest in a free filing option from the IRS. However, there were also concerns that a tool from the government wouldn’t be easy to use. With positive feedback on the internal prototype, the team got the green light to continue conducting research on a larger scale through the Direct File pilot.

The leadership team had originally planned out an 18-month roadmap. But when the work finally got approved in May 2023, they only had 7 months. They were undeterred, and set about defining an MVP scope that was achievable in that timeframe AND robust enough to determine if an easy, secure, and free tax filing tool from the IRS was feasible.

To empower people to confidently and accurately file their own taxes, for free, directly with the IRS.

Discovery

Direct File doesn’t impose an arbitrary income limit on eligibility. Instead, it follows the precedent of the Volunteer Income Tax Assistance (VITA) program. VITA aims to assist low-income taxpayers (along with some other categories) by identifying the tax provisions most relevant to these audiences.

With this in mind, Direct File focuses on tax scope common for low- to middle-income working individuals, couples, and families with wage income. Scope is considered based on 4 criteria:

Given the tight timeline, the team identified a limited MVP scope for the Direct File pilot tailored to this audience.

| Basics |

|

|---|---|

| Income |

|

| Deductions and credits |

|

Building a foundation

Through conversations with taxpayers, the early design team drafted guiding principles that fundamentally shaped what we built and how we worked. (Such wonderful work from Suzanne Chapman, Jen Thomas, and Selene Diaz.) Here are some highlights.

Design

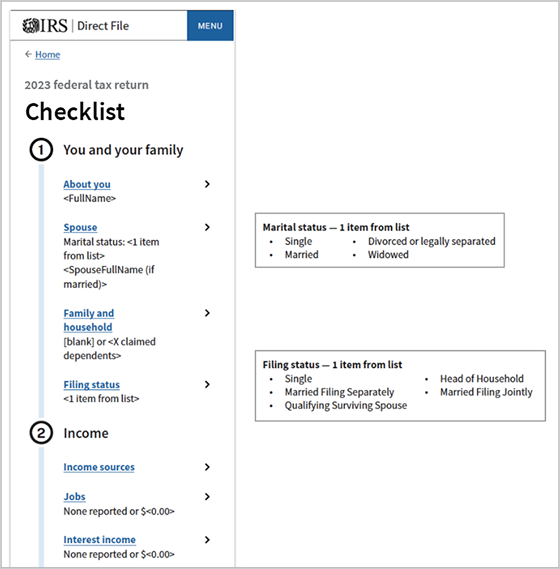

The team ended up designing and building over 350 screens for the Direct File pilot, with more than 1,000 facts under the hood that captured data on the filer’s tax situation. The tool structures the federal tax return into 5 main sections:

I joined the project in July 2023 and divided my time between 4 core efforts:

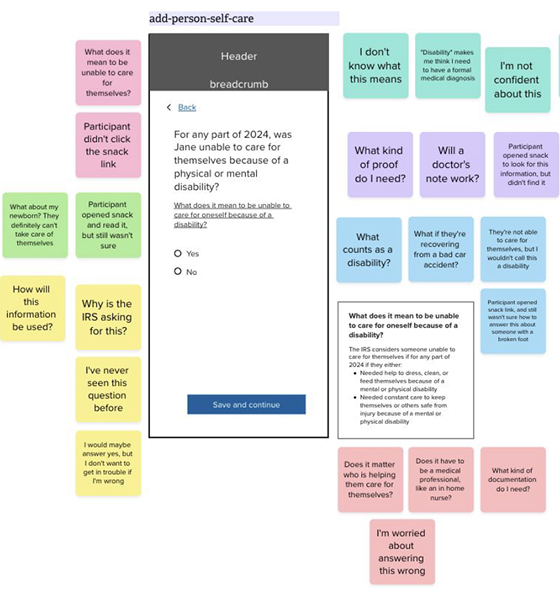

When I started in July, I became the third designer on the Tax Logic team. This group created userflows and wireframes of major sections in the tool. We were tasked with identifying what questions needed to be asked to generate an accurate and complete tax calculation. We also considered how and when to ask questions and what supplemental information should be provided to guide taxpayers through complicated information.

I quickly took over as lead designer for the Income section. The amazing Katie Aloisi had already drafted a detailed first round of screens, and I was responsible for continuing to build out and polish this section.

Explaining taxes—A big part of my job was breaking down complex concepts into plain language that taxpayers could understand. This work involved careful reading of tax publications and consulting regularly with tax lawyers at the Treasury and IRS Chief Counsel. Together, we translated tax code into guiding questions that were clear, concise, and accurate.

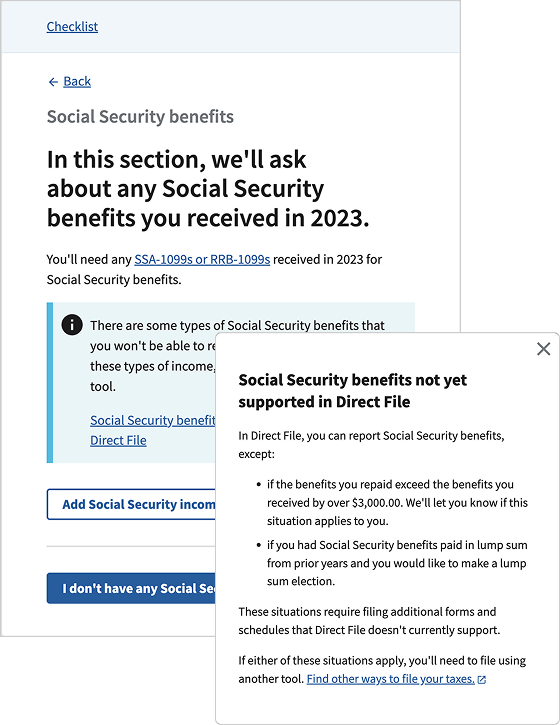

Patterns to emphasize limited scope—The Direct File pilot only supported a handful of income types. Since there are serious consequences for failing to report income to the IRS, it’s critical that users are able to correctly evaluate if their income situation is supported. I made a number of changes to the Income section to emphasize the limited scope, including tweaking the information architecture on the main navigational Checklist to be extra explicit about scope and adding comprehensive scope flags about what wasn’t supported.

A few months in, I also joined the Refinement team. This was a group of designers and engineers focused on building and polishing the tool’s UI elements for better usability. The Direct File team had grown significantly over the summer, and Tax Logic and Refinement were feeling too siloed. My goal was to increase collaboration and coordination between the teams, to help us all work more efficiently as we built the design system and tool at the same time. I led weekly working sessions with designers and engineers to kick the tires on in-progress work. And I coordinated with Tax Logic on their road map. In no time, our speed for building new patterns increased significantly. And the work got better, because the whole team was better informed and able to take ownership of key decisions.

I also designed many components, key navigational screens, and system-wide states. For example, I took lead on polishing the Checklist, the main navigation screen for Direct File. I took special care with this screen to be sensitive to different life situations. Summarizing someone’s year (and life choices and circumstances) with categories about marriage, children, and income can be triggering for a variety of reasons. When drafting conditional content to go under each subsection, I was particularly careful with empty states and avoided using None.

Johanna brought an incredibly valuable combination of curiosity, intelligence, creativity, and empathy to every problem she approached. Whenever I saw a challenging section of the roadmap headed to a design/product/engineering team, if I saw Johanna was overseeing it, I was able to relax, knowing the end product would make me proud. Any team would be fortunate to have her, and I would be overjoyed to work with her again.

—Matt Bowen, USDS and Direct File group engineering lead

We had a great team dedicated to user research and usability testing. I partnered regularly with this team to evaluate my in-progress work. At the beginning of a testing round, I recommended research goals and identified tricky functionality or concepts to explore. And during sessions, I observed, took notes, helped synthesize, and then used the findings to iterate on designs (and help determine priorities). This work became even more timely during filing season, when we were able to learn from taxpayers filing their real taxes.

Early testing of the Income section—Usability testing with our initial designs helped us identify confusing areas of the Income section. For example, we learned participants regularly misunderstood concepts like digital assets and corrected or nonstandard Forms W-2. We also found that multiple people didn’t quite understand the scope limitations for the Income section. I made a number of copy updates throughout the section to clarify these issues.

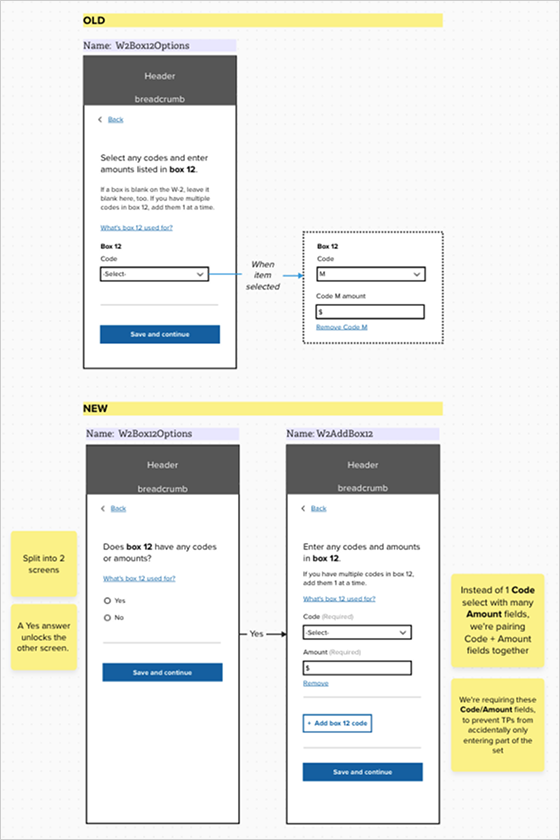

Feedback during filing season—We continued to glean valuable insights from taxpayers during filing season, and were able to make small content and functionality changes in real time to fix issues. For example, we learned some filers were accidentally selecting the wrong button on multi-button screens. I formed an impromptu team to workshop our button styles, and we were able to push changes right away that performed much better. Another example: we learned people were struggling with Form W-2 boxes 12 and 14. This was not a total surprise—we had some tasks in our lengthy backlog to improve these screens—but the data helped up prioritize these changes. I teamed up with an engineer to create a couple tiers of updates—some content ones that we pushed quickly, and more substantial functionality changes that were implemented later in filing season.

Because I worked on multiple teams, I ended up collaborating with almost everyone on the client side of the tool. This gave me a unique perspective into what people were working on and how they were approaching problems. I learned a lot from my teammates about tackling gnarly tax scope, and I did my best to pay this knowledge forward. I would regularly mentor other designers on the team, lead cross-functional working sessions, connect people addressing similar issues, and share practices to help us collaborate better.

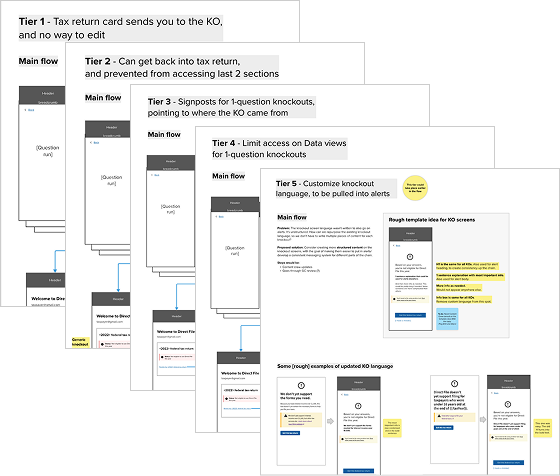

One of my favorite practices (that became a running joke on the team) was designing tiers of implementation. I’d often set up regular check-ins with engineers, to share in-progress work early and often. And a common outcome of these meetings was learning that a proposed design was too complicated. This was a great conversation starting point, and helped us identify what would be most feasible to implement first. I’d then design multiple tiers of updates that could slowly be implemented over time. This practice proved essential for launching on time, and helped us establish a culture of tight designer-engineer collaboration.

The great thing about working with Johanna is that when you give her a gnarly problem, you know it’s going to get solved—and solved the right way. She always digs into the why, keeps the focus on the user, and works hand-in-hand with teammates to deliver products that are both valuable to the user and practical to implement. She’s the kind of partner I want in the foxhole with me: smart, steady, and all in.

—Jen Thomas, Direct File design lead for Tax Logic

How it went

The research team did an amazing job setting us up to learn from taxpayers during filing season. (This is no small feat in government.) We had lots of avenues to capture feedback on Direct File: customer support transcripts and surveys, a taxpayer post-submission survey, usability testing, and social media listening. And we were honestly blown away by peoples’ reactions.

Respondents to the taxpayer post-submission survey gave the pilot dizzyingly high marks.

90%

described their experience as

Excellent or Above Average

86%

said Direct File increased

their trust in the IRS

+74

Net Promoter Score (NPS)

approval rating

They also had some lovely things to say.

“Clear instructions...Everything was fast and directions and links were easy to follow.”

“The entire system made me trust that my taxes were done correctly.”

“I design many forms for my job and conduct accessibility audits of them, and this entire experience just made my heart leap for joy. A few years ago, I was brought nearly to tears the first time I filed my taxes with paper forms. Since then, I've studied a range of best practices and standards for easily usable and accessible online form design, and this Direct File system nailed every single one of them. I am so beyond impressed, and I sincerely hope this program continues and expands in the future.”

We even got positive media coverage.

Looking ahead

Due to the success of the pilot, the IRS announced in May 2024 that it would make Direct File a permanent option for filing federal tax returns starting in the 2025 filing season. Ths IRS also committed to continually expanding scope, functionality, and access to more states.

“The clear message is that many taxpayers across the nation want the IRS to provide more than one no-cost option for filing electronically. So, starting with the 2025 filing season, the IRS will make Direct File a permanent option for filing federal tax returns. Giving taxpayers additional options strengthens the tax filing system. And adding Direct File to the menu of filing options fits squarely into our effort to make taxes as easy as possible for Americans, including saving time and money.”

—IRS Commissioner Danny Werfel

Shoutout

I’d be remiss not to mention that the Direct File team has been one of the smartest, kindest, and most dedicated teams I’ve ever worked with. And that wasn’t by accident. Our amazing leadership team of Bridget Roberts, Chris Given, and Merici Vinton worked hard to bring together the right people for the job. They provided a laser-focused vision for the future of tax filing, but also empowered the team to take ownership and make decisions necessary for a feasible MVP. This combination of vision and realism were guiding forces for the pilot. I’m so grateful for their leadership, and so in awe of what we were able to accomplish together.

Links

If you’re excited about taxes and want to learn more, lots of smart people wrote about the Direct File pilot. Here are some resources to check out.

A Cinematic Look at Time Travel

IRS Direct File | Year 2