Project

“I don't cry filing my taxes with Direct File.”

—Response from taxpayer post-submission survey

In May 2024, the IRS announced it would make Direct File a permanent option for filing federal tax returns. The pilot had successfully demonstrated the feasibility of an easy, secure, and free filing tool from the IRS. It had also shown that taxpayers were interested in (and sometimes quite excited about) the tool, and were looking forward to it supporting more tax situations. (For more on year 1, you can read my write-up on the Direct File pilot.)

Year 2 was all about expanding scope and functionality. In addition to making more taxpayers eligible to use Direct File (eligibility doubled to 32.2 million taxpayers), this gave us the opportunity to test out how well our existing design patterns and code structures could scale. And it gave us lots to consider for the future.

I continued as a design lead for year 2, and took on more responsibility and gnarlier tax scope. I mainly focused on building out the Income section, with an eye towards supporting more tax situations and adapting the information architecture (IA) for long-term growth. I also tackled some new Deductions and Credits.

The team stayed largely the same, though we added some excellent new colleagues. Many of us (including me) joined the brand new in-house Direct File team at the IRS, becoming IRS employees.

Discovery

The target audience for Direct File remained the same in year 2: low- to middle-income working individuals, couples, and families with wage income.

Scope decisions were still based on our 4 criteria:

We also had useful data from the pilot about what scope limitations taxpayers were finding the most confusing and what unsupported tax scope was most requested. For example, the team considered retirement income and Form 1099-R important but had not included it in the pilot due to complexity. During the pilot, support for retirement income was a top request. And multiple taxpayers incorrectly tried to report Form 1099-R in the Social Security benefits section, which led to an inaccurate return. Given its importance to taxpayers, and to ensure taxpayers use Direct File accurately, the team prioritized retirement income in year 2.

The team once again had a tight timeline, since we got approval to expand in May. We got to work identifying what scope made sense to add for filing season 2025. We largely chose more challenging tax items than the previous year, taking on some hefty scope like the Premium Tax Credit.

| Basics |

|---|

|

| Income |

|

| Deductions and adjustments |

|

| Credits |

|

| Basics | Income |

|---|---|

|

|

| Deductions and adjustments | Credits |

|

|

To significantly expand the tax situations supported by Direct File, so more people could confidently and accurately file their own taxes, for free, directly with the IRS.

New functionality

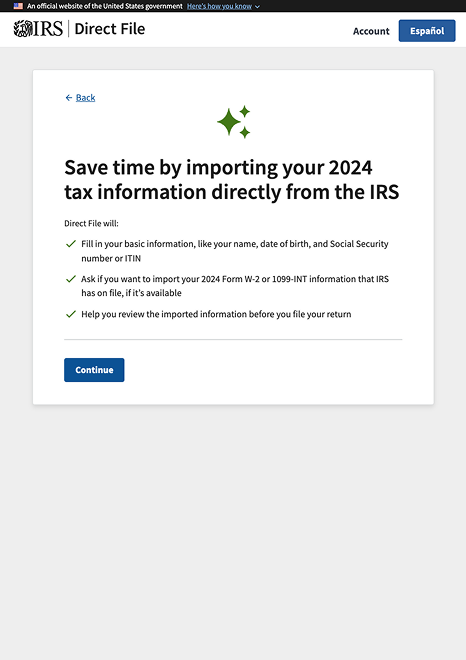

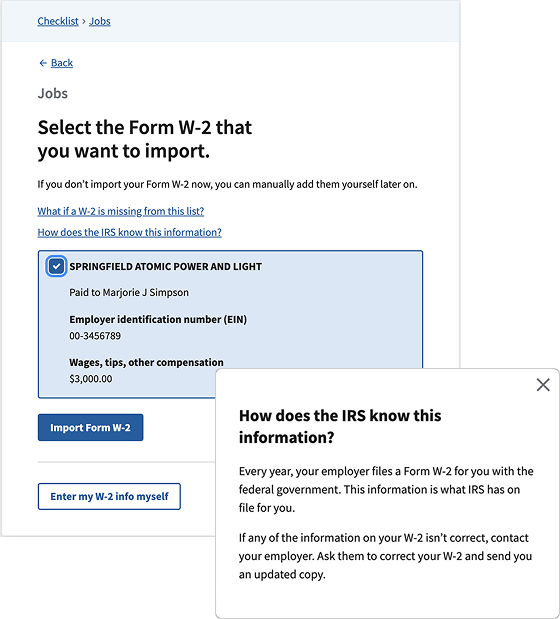

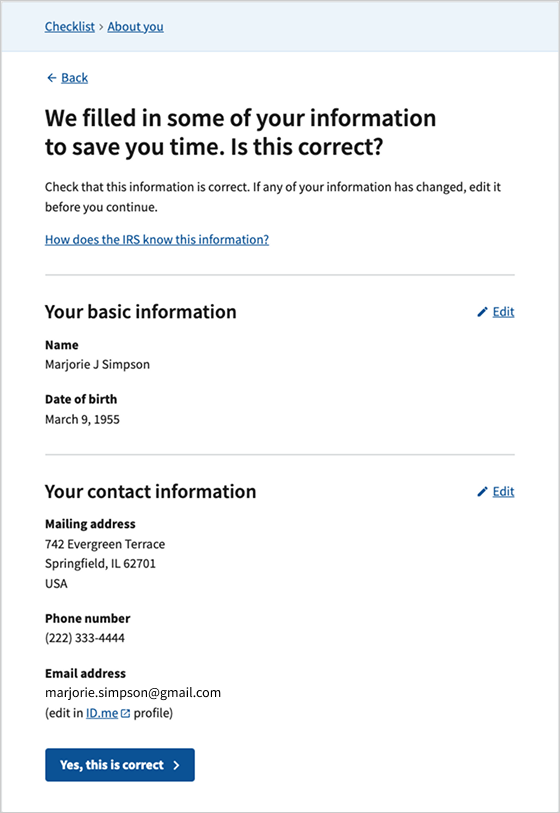

The most exciting update to Direct File for filing season 2025 was data import. I didn’t work on this new functionality, but it’s too exciting not to talk about.

“If I’m going to the IRS website, I would assume they have the information already.”

—From a taxpayer user interview

Every year, taxpayers gather tax documents and manually enter that data on their return. This manual entry is burdensome and error-prone, and it can feel unnecessary because the IRS receives the same source documents. In our user research, taxpayers requested again and again that the IRS pre-populate information it already knows about them on their federal tax return. This functionality had never been feasible before, because the legacy systems don’t talk to each other, and the IRS had lacked the resources to modernize them. The newly-formed Direct File team set our sights on experimenting with this functionality.

The team took an iterative approach and set modest goals to test the new system they were building (in collaboration with other IT teams across the IRS). It ended up performing very well, and the team rolled out multiple data import features to all Direct File users over the course of filing season 2025. Direct File offered the option of importing the following for the primary filer (the one who signed in and authenticated):

Taxpayers found data import to be easy-to-use, intuitive, and a welcome addition to Direct File. Some noted it saved them time. Others said it reminded them about a form they didn’t know they needed to report. Others looked forward to more income tax forms getting imported in the future.

We also learned a lot from this initial experiment, including about some limitations with the data the IRS has access to. For example, employers transmit Forms W-2 to the Social Security Administration (SSA), and only some of that data is then passed along to the IRS. This data is sufficient for IRS administrative purposes, but it isn’t complete for taxpayers filing their return. Also, a number of income tax forms like Forms 1099-INT and 1099-R aren’t due in digital form to the IRS until March 31. So data import can currently only be available for those forms at the very end of filing season.

There’s a huge opportunity for data import to transform the way taxpayers file their taxes. And the team is very excited about the implications of this new functionality, such as:

Design

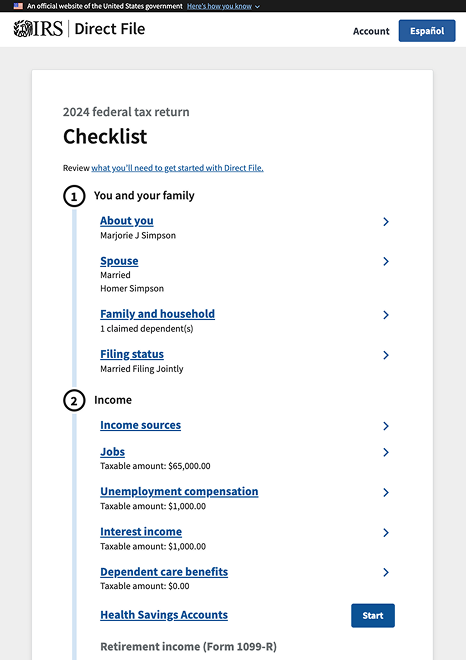

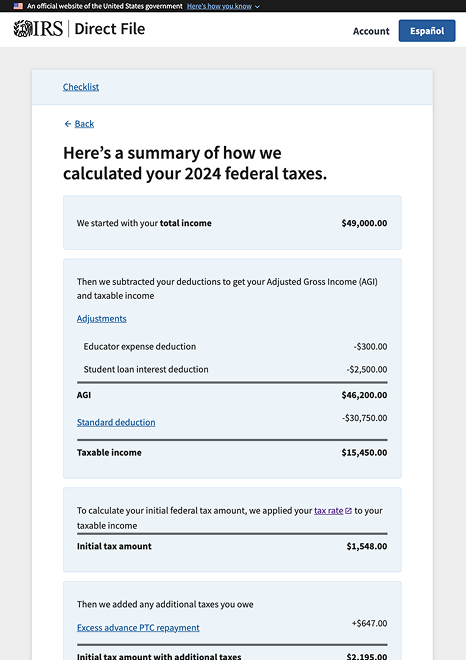

The team added hundreds of new screens for the 2025 filing season, totaling some 700+ possible questions. (Though no taxpayer would ever see close to that many.) The overall structure of the tool stayed largely the same, with the same 5 main sections: You and your family, Income, Deductions and credits, Your 2024 taxes, and Complete.

In year 2, I worked exclusively on the Tax Logic team and expanded into more sections of the tool. I was design lead for:

I also consulted on the Retirement Savings Contribution Credit (Saver’s Credit) and retirement income (Forms 1099-R).

There’s a lot of scope to discuss here. I’d like to focus on 2 areas I found particularly interesting: HSAs and future opportunities for the Income IA.

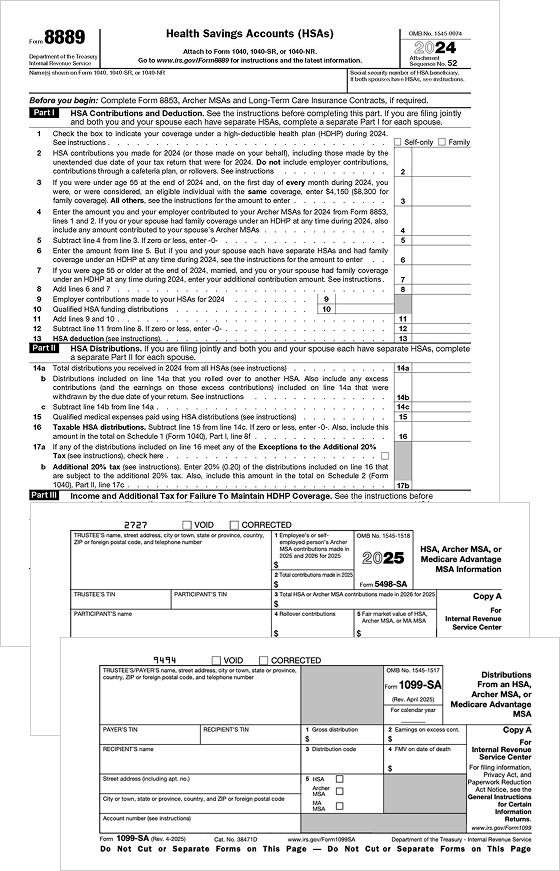

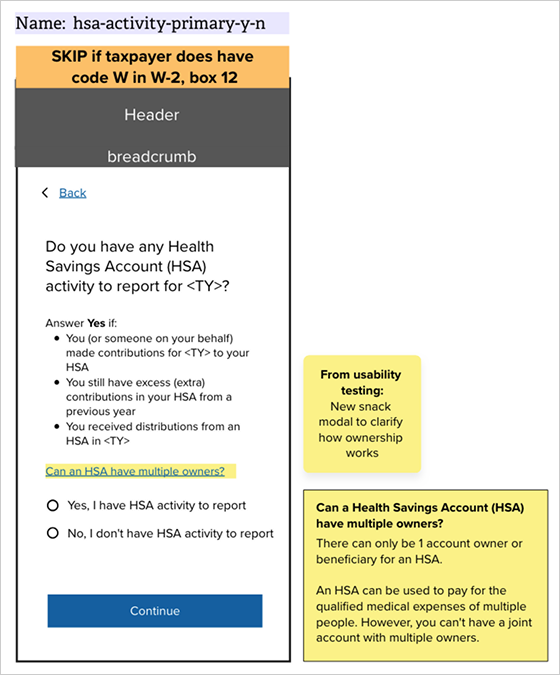

I was the design lead for HSAs, which are a type of tax-advantaged account. With an HSA, if you follow certain rules, you can set aside money pre-tax to pay for medical expenses.

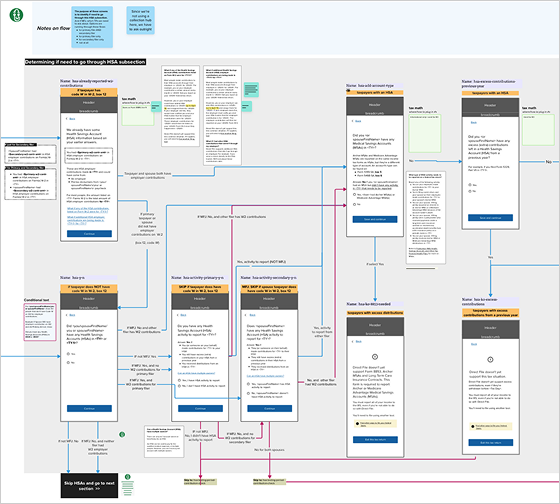

HSAs are more complicated than the income types supported in the pilot, so they proved useful for testing how well our existing patterns scaled. We took an iterative approach—we built a minimum viable product (MVP) that supported simple HSA tax situations, tested it before and during the 2025 filing season, made incremental updates based on this research, and walked away with great user feedback that will guide continual, long-term improvements to HSAs and the expanding Income section.

The Direct File pilot supported income types that were relatively straightforward to report. The taxpayer receives an income tax form (like a Form W-2 or 1099-INT) that lists all the needed data, and then Direct File asks for that data. Reporting of HSAs is more complicated, because Direct File has to ask additional questions about how well the taxpayer followed the rules for adding money to the account (contributions) and taking money out of the account (distributions). These rules can be confusing, and answers to these questions aren’t marked on a form—the taxpayer just needs to know them. And since taxpayers often set-and-forget these types of accounts, the details can be challenging to recall.

Also of note, HSAs don’t fit neatly into 1 tax category. They best align with Income, but they don’t really feel like income, because the money usually isn’t going into the taxpayer’s pocket. For many taxpayers, HSA contributions or distributions won’t affect their federal tax return at all. It’s just something they need to report. But depending on their situation, HSAs can potentially affect Income or Adjustments or cause the taxpayer to owe Additional Taxes.

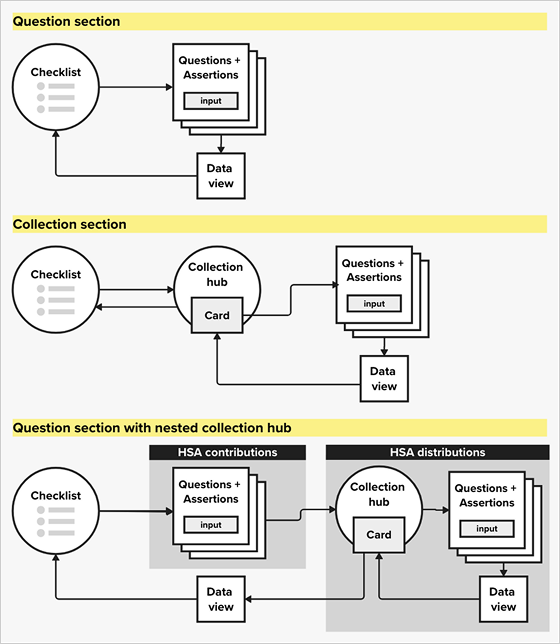

Our existing patterns didn’t quite accommodate the contribution/distribution setup of HSAs. Structurally, we had 2 patterns for collecting information:

In the pilot, we didn’t mix these patterns in a single section.

I collaborated closely with engineers to find the right MVP approach to support HSA contributions and distributions. My initial design involved a new navigation page, which proved too disruptive for our first pass. So we opted for one long HSA section with contributions and distributions all together. We called it a Question section with a nested Collection. (What a mouthful.)

Our new hybrid pattern proved a little more cumbersome for engineering than expected, but it provided a good foundation for testing the structure for tax-advantaged accounts in Direct File. We were eager to learn how well this setup guided taxpayers, and where they still got confused. (HSA rules are confusing, so we expected some confusion.)

Once we determined the structure of the HSA section, I got to work identifying what questions needed to be asked to accurately and completely fill out Form 8889, which is the attachment needed for HSAs. My responsibilities included:

In the end, I designed ~60 HSA screens for the 2025 filing season. These included questions to verify the taxpayer was following the rules of their account, plus a Collection hub to report HSA distributions (Forms 1099-SA).

We had an amazing team of researchers who gathered insights before and during filing season. I partnered with them to test the new HSA section. We learned a lot about where taxpayers got confused, especially around the rules for contributions. Some highlights:

Thanks to our robust research-to-action pipeline, I was able to make content tweaks throughout filing season to address taxpayer questions. We could see from customer support chats that these updates resulted in fewer HSA questions, which was great. The research findings also helped me zero in on where taxpayers could use additional guidance with their HSAs. This was immensely helpful and gave me a lot to consider for future improvements.

Johanna embodies the Direct File team’s value to “do the hard work to make it easy.” She immerses herself in complexity only to return with a clarity of intent necessary to deliver an accessible, delightful user experience. In order to realize her vision, she collaborated confidently with IRS counsel and software engineers. The harder the problem, the more I’d want Johanna on the team.

—Chris Given, Direct File product lead

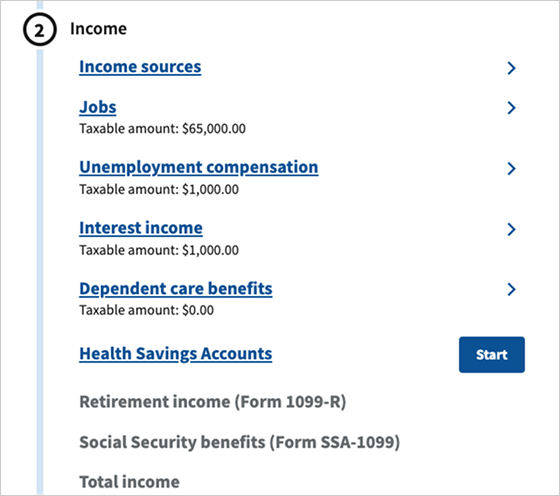

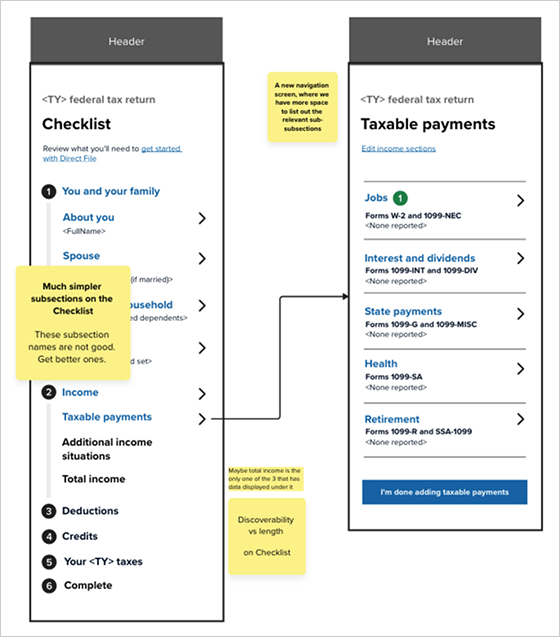

The current Income section IA prioritizes a limited tax scope, and I always intended it for short-term use. At the moment:

This setup worked great for a small set of supported income types, but it’ll get too long and cumbersome as the tool continues to grow.

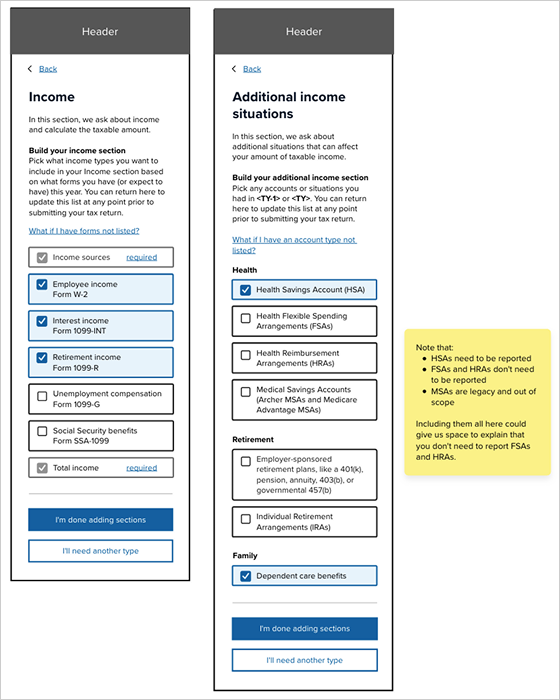

At the end of filing season 2025, I brainstormed with some teammates on how the Income section could adapt for new tax scope and functionality. Much of this ideation came from our recent learnings from HSAs and data import. I’d like to share a couple quick iterations I put together, which include lots of hypotheses and questions for further exploration.

In filing season 2025, the Income section mixed straight reporting of data from an income tax form with challenging follow-up questions about complex tax situations. This makes the taxpayer jump back and forth between different mental models. And we heard taxpayers sometimes struggled with the challenging follow-up questions.

Hypothesis—It’ll be easier logistically (for taxpayers and engineers) if we separate concerns.

Outstanding questions:

Hypothesis—Direct File should customize the Checklist for each taxpayer, so they only see income types relevant to them. This could involve:

For taxable payments, this would give taxpayers 1 place to opt in or out of all the income types. And an easy place to change their settings, if they need to add or remove an income type.

For other tax situations, this would help us identify if taxpayers have certain types of accounts, and then drill into more questions accordingly. It would also give us a place to acknowledge similar account types that don’t need to be reported, which we heard taxpayers find confusing.

Outstanding questions:

There’s a lot of exciting potential for the expansion of Direct File, and I ended the filing season curious to dig deeper into these hypotheses and continue testing and refining with taxpayers.

I was so fortunate to work closely with Johanna during my time as principal product manager for IRS Direct File. Taxes are incredibly complicated, but Johanna was able to break down complex processes, map out ideas, organize the information architecture, and test and incorporate user feedback. She’s also an incredible collaborator and was key in helping us grow a cross-functional team that built easy to use, fast and secure software together. You need Johanna on your team!

—Megan Sowder-Staley, Direct File principal product manager

How it went

We assumed that with more taxpayers using Direct File in its second year, our survey scores would go down. We were wrong.

Respondents to the taxpayer post-submission survey gave Direct File even higher marks.

94%

described their experience as

Excellent or Above Average

Up from 90% the prior year

+80

Net Promoter Score (NPS)

approval rating

Up from +74 the prior year

They continued to have lovely things to say.

“Legit no notes, this was the easiest most pain-free process and I had zero anxiety.”

“These people are truly the best of the best nerds.”

“I really appreciate the simple, plain language. Even as simple as saying, ‘If this box contains other codes, thatʼs okay.’ It was like a person talking to me.”

“Everything on the screen was helpful and informative, not overwhelming, so I feel like I both did things right AND understood what was happening.”

The nature of our media coverage changed a lot, though. While much of the media coverage in 2024 focused on the appeal of Direct File as a free filing option, media coverage in 2025 focused on whether Direct File still existed and would continue to exist. With the administration change, there was a lot of uncertainty about the future of Direct File, and it appeared to deter many people from using the tool. (Increasingly catastrophic headlines resulted in spikes in customer support questions and a drop in usage.) Also of note, the IRS chose to deemphasize Direct File on IRS.gov, and taxpayers had trouble finding it. These developments were disappointing and resulted in fewer users than we had anticipated. Still, we were proud of the 296,531 accepted returns filed through Direct File in filing season 2025 (up from 140,803 the prior year).

Looking ahead

This is where the story takes a sad turn. The administration decided not to continue supporting Direct File, and the team left the IRS or moved onto different projects. I’m sad Direct File won’t be available for taxpayers next year, but I’m so damn proud of what we accomplished. As our fearless product lead, Chris Given, told us as we departed: “We took a pipedream and made it a policy choice. No one can claim with a straight face that Direct File is impossible anymore; bringing it back requires only that our elected leaders make a different choice.”

There’s so many opportunities for Direct File to get better and better. I hope it will be back someday—making it easier for people to file their taxes AND redefining expectations for how government can work for the people. The next version of Direct File is the best version of Direct File.

Shoutout

In year 2, the Direct File team got even better. My teammates tackled so much complicated tax scope and functionality. We were growing the tool but also our capacity to deliver for taxpayers at the IRS. It was nothing short of inspiring.

I’d like to give a special shoutout to my fellow Tax logic designers—Jen Thomas, Katie Aloisi, Jess Ondusko, Allison Abbott, Andre Jolivette, Amanda Sparks, and Sunil Manchikanti. And to our amazing Tax Logic content designers—Britt Brouse and Erin Gamble. It was such an honor to work with these fine folks, and I couldn’t be more grateful for their dedication, care, friendship, and stubborn optimism.

Links

There’s lots of great resources to learn about year 2 of Direct File.

IRS Direct File | Pilot

NCARB + EightShapes